BUDGETING is essential if you want to manage your cash well, and it’s a lot easier with a money management app.

Whether you want to make your cash stretch until payday or you’re keen to start saving, there are plenty of tools available to help you do this.

We pick out ten of the best money management apps available

Today we reveal our favourite money management apps as part of our Consumer Crew Fix Your Finances series.

From Cleo to Yolt, we’ve scanned the market to pick the ten best money management apps currently available.

Forget pouring over spreadsheets and adding up receipts and transactions – these digital tools will do it for you.

A majority of the apps use “Open Banking” rules, which came into force in January 2018.

They mean banks and other financial services providers have to share your personal details safely and securely – as long as you give your permission.

The apps we’ve picked out, apart from GoodBudget and Wally, are regulated by The Financial Conduct Authority (FCA).

Meanwhile, GoodBudget and Wally don’t require access to your personal data, so you don’t need to worry about giving them too much information.

All of the ten apps are free, but some may charge for premium versions so watch out for this when you download them.

Cleo

Cleo is a budgeting app that also doubles up as a automatic savings app.

By connecting your bank accounts, the app then assesses how much you spend and what you could do to save more money.

You can set it up so that it puts money into a savings pot, rounds up your spending or even set a “swear jar”.

Not sure whether you can afford that pizza? Just ask the Cleo chatbot and she’ll let you know, based on how much money are in your accounts and how long you’ve got left until payday.

Emma

Emma helps you you track your bank fee chargesOnce you’ve added your accounts and cards to Emma, the app will help you avoid overdrafts and find wasteful subscriptions.

It helps you track your spending too, to show you what you can cut back on to increase your savings.

When the app launched in 2018, it reckoned it could you save users £600 a year by tracking direct debits and helping you avoid extra bank fees.

Goodbudget

If you aren’t keen to use Open Banking, you may want to consider downloading the Goodbudget app, which helps you keep track on budgets.

It requires you to input the data yourself, which can take a lot of time, but you won’t have to share any personal details.

One handy feature with the app is the possibility to share budgets with other users, such as a partner or parent.

HyperJar

HyperJar, which launched last year, is an app and prepaid card that helps you plan and grow your money.

Users simply divide their money into virtual jars depending on where they want to spend, whether it’s expenses like food and petrol or future holidays.

Once you spend your money, you’ll earn up to 4.8% interest at retailers including Dyson, Shell and Bloom & Wild.

Just keep in mind that any cash you deposit isn’t protected by the Financial Services Compensation Scheme (FSCS).

Instead, HyperJar says it keeps your funds in accounts governed by the e-money regulations of the FCA, similar to PayPal and Transferwise.

If HyperJar went bust, it promises that 100% of the money you had paid in would be returned to you directly from these accounts.

MoneyDashboard

MoneyDashboard lets you categorise your spending so you can keep track of where your money is going

MoneyDashboard lets you categorise your spending so you can keep track of where your money is going

MoneyDashboard is available as an app as well as on desktop, and it links your accounts so you can see them all in one place.

You can categorise your spending so you can keep track of where your money is going.

One handy feature about the app is that it tells you how long you have left in the month and how much you’ve got according to your budget.

To do this, you need to set up your pay cycle (the day when you get paid) and add any scheduled payments that you have, such as bills, rent or a mortgage.

Moneyhub

The Moneyhub app is similar to MoneyDashboard by categorising your transactions so you know what you’re spending most money on.

You can also check how your spending and earnings have changed over time, and whether you’re able to afford certain purchases.

If you’re saving for something in particular, you might like the feature that gives you an insight into your financial future based on your current situation.

Personalised advice is also available from financial professionals through the app.

Plum

Smart money management app Plum is designed to automatically set aside cash without you even thinking about it.

The app allows you to round up any purchases you make or set up an amount to move into a pot on the account on your payday.

It works if you’re in an overdraft, which means you could start using the savings it finds to pay off your overdraft.

This is handy because overdrafts are one of the most expensive forms of debt, with some charging up to 49.9% interest.

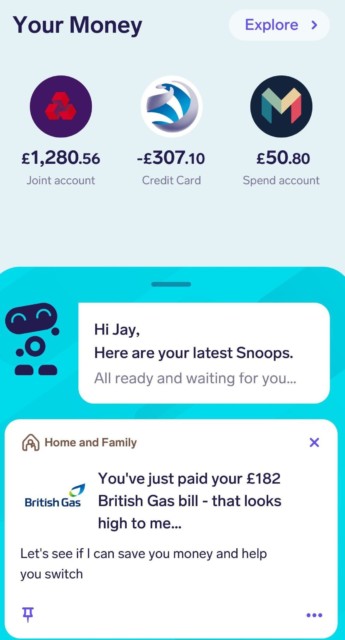

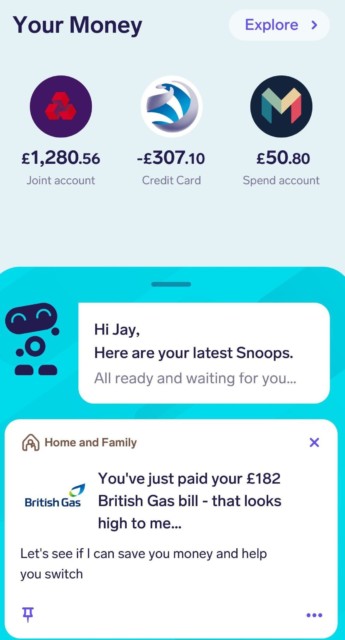

Snoop

Snoop is one of the newest money management apps available

Snoop is one of the newest money management apps available

The Snoop app launched in April and it reckons it can boost your bank balance by up to £1,500 a year by giving you personalised savings ideas.

Once you’ve connected your accounts, Snoop uses a mix of artificial and human intelligence to help you make the most of your money.

This could include smaller things like pointing out a better way or place to buy your daily coffee or how to get money off your mobile bill.

It also includes bigger things such as switching energy provider and re-mortgaging deals.

Wally

Wally tracks your accounts, spending, and lets you set budgets to help you reach your financial goals, but you’ll need to put in the data yourself.

The app was launched in 2014, and now supports a wide range of currencies.

This enables you to keep on top of your spending no matter where you are in the world once coronavirus restrictions are eased.

Yolt

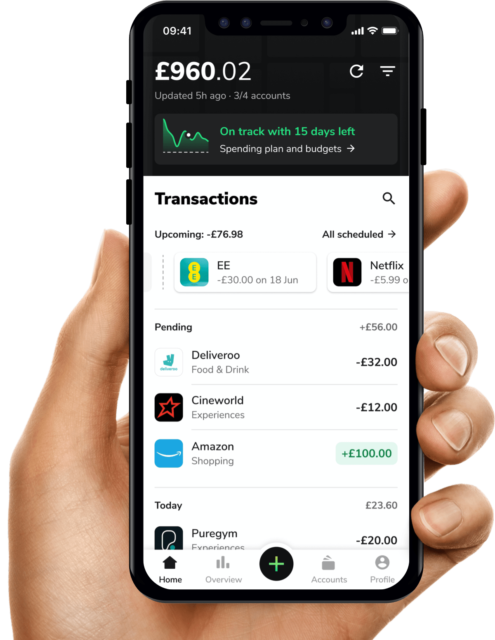

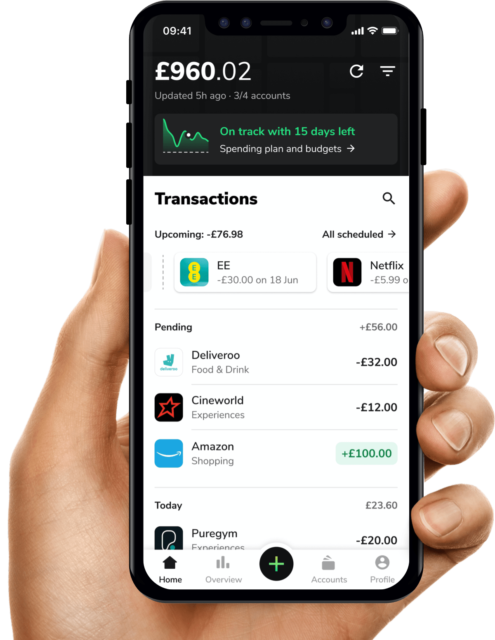

Smart money app Yolt is easy to use and clearly displays what you’ve spent.

It was originally built as a budgeting app with Open Banking roots, enabling users to see all their financial accounts in one place.

But in November, a new version of the platform launched and it now has features to help users save while they spend too.

These include a card and account for daily spending, a separate “Money Jar” for savings and “Jar Boosters”.

The latter automatically put aside leftover change and unexpected windfalls in the form of a refund, a salary increase or even a bonus.

Yolt users are also able to earn cashback at retailers and restaurant chains including Argos, Asos, Domino’s and John Lewis.

HOAR has spoken to a few savers who are using auto-saving apps to help them save thousands of pounds without noticing.

As part of our Fix Your Finances series, we’ve also explained how to save £2,530 in a day by cutting bills and giving your finances a makeover.

Plus, two debt advisers have shared eight money saving secrets.