INVESTORS using popular online trading platform eToro were locked out of their accounts yesterday afternoon just as the cryptocurrency markets crashed.

The site is live again this morning but investors are complaining that they may have lost money by being unable to sell holdings such as Bitcoin and Ethereum which suffered declines yesterday.

Follow our cyptocurrency live blog for the very latest news on Bitcoin, Dogecoin and market surges…

eToro lets users trade shares and cryptocurrencies commission-free

What is eToro?

eToro is a share trading platform that lets investors around the world buy and sell shares and currencies.

Users can build their own portfolio or copy others and there are no trading or management fees.

There is a $5 charge for withdrawals and a $10 a month inactivity fee if you don’t login for 12 months.

The platform started offering cryptocurrencies such as Bitcoin, Ethereum and Ripple in 2019.

The only charge for purchasing cryptos on eToro is the spread, which is the difference between the buying and selling price.

This provides a low-cost way for investors to buy stocks and cryptocurrencies through a trading platform that is regulated by the Financial Conduct Authority (FCA).

The platform said this week that the number of people holding Bitcoin on the platform at the end of January 2021 compared with the same time a year ago has more than doubled, seeing a 106% increase.

Ethereum has followed suit, up 82% year-on-year.

It coincided with the price of Bitcoin and Ethereum hitting record highs during 2021.

Why did eToro crash?

eToro users began reporting issues with logging into their accounts yesterday afternoon.

It coincided with a dip in the stockmarkets due to a sell-off of technology stocks and also a large decline in the value of two of the largest cryptocurrencies Bitcoin and Ethereum.

Bitcoin’s price fell 14.8% in a day yesterday to $48.397, according to crypto website Coindesk.

Ethereum fell 18.7% to $1,559.

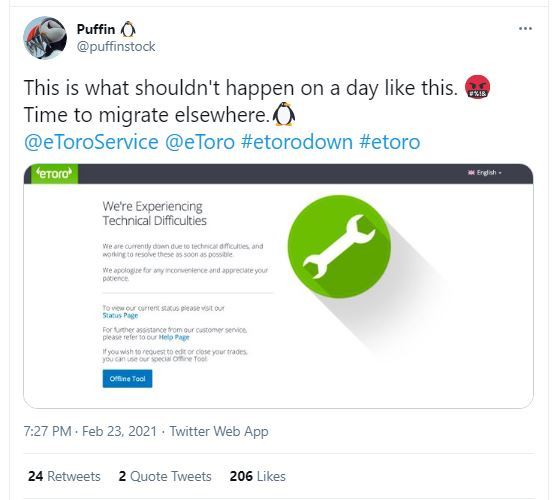

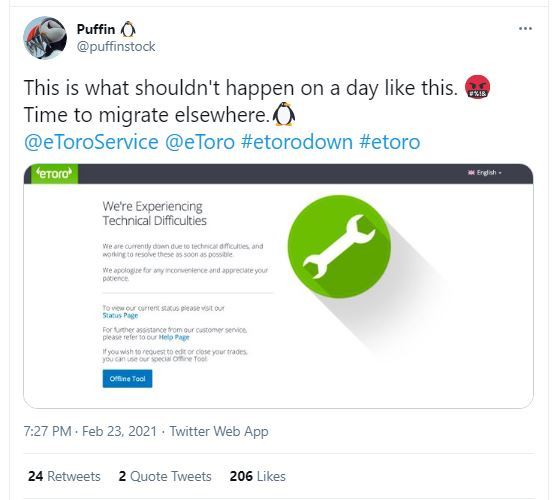

One Twitter user said: “This is what shouldn’t happen on a day like this.”

Investors were angry that eToro was down during a volatile moment for markets

Investors were angry that eToro was down during a volatile moment for markets

A message on the eToro website said it was experiencing technical difficulties and apologised for any inconvenience.

An update on the eToro website at 315pm UK-time yesterday said: “The root cause of the issue has been identified and our developers are working to fix it.

“Additional information will be provided as soon as possible.

“We appreciate your understanding and apologise for the inconvenience.”

The website was down until 855am this morning, meaning investors were unable to make trades for more than 17 hours.

eToro said the reason for the service disruption was a technical issue that “affected our Microsoft database and we were forced to move the platform into maintenance mode.”

The statement said: “Our platform is back up and running and we want to reassure our clients that our systems were not compromised in any way.

“This was not a breach or an attack on our systems and we have not experienced any data loss of any kind.”

The move has angered investors though as users were unable to make trades just as stockmarkets and the value of cryptos were falling.

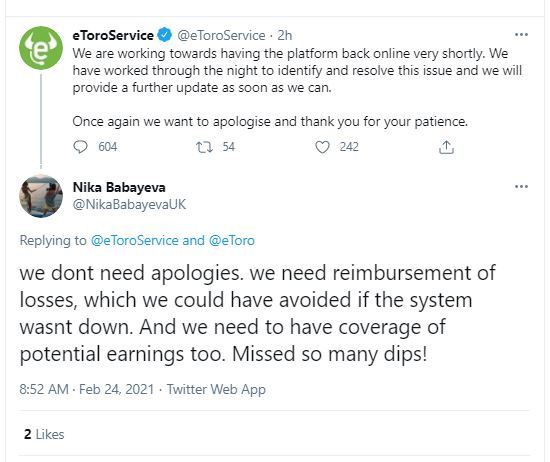

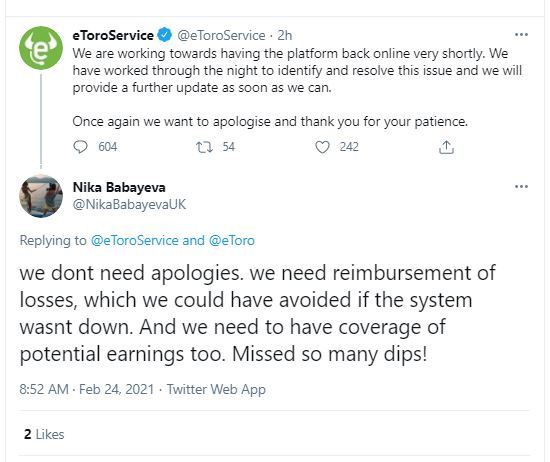

Some are calling for a “reimbursement of their losses” on Twitter and there is already a petition calling for “justice for eToro victims.

eToro users want compensation for any losses

eToro users want compensation for any losses

The statement from eToro added: “We would like to apologise for the disruption and to assure our customers that we are continuing to invest heavily in our systems and our support teams.

“Our customer service team will be working around the clock to answer individual customer enquiries.”

How have crypto markets crashed?

The price of cryptocurrencies such as Bitcoin and Ethereum have hit record highs in recent months.

Tesla founder Elon Musk helped push the value of a single Bitcoin to beyond $48,000 (£34,680) earlier this month after revealing that the car maker has invested $1.5 billion in the virtual coin.

The price of a single Bitcoin hit a record $58,354 on Sunday but it has been dropping in recent days hitting $51,248 this morning, a 12.4% drop.

This shows how volatile and risky the cryptocurrency is.

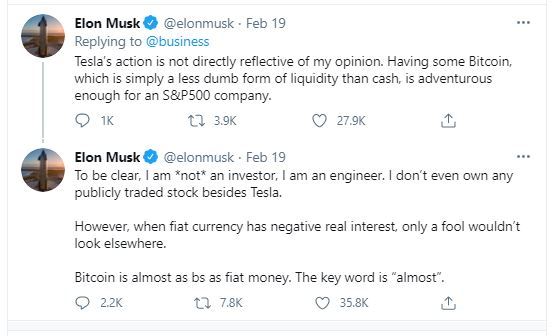

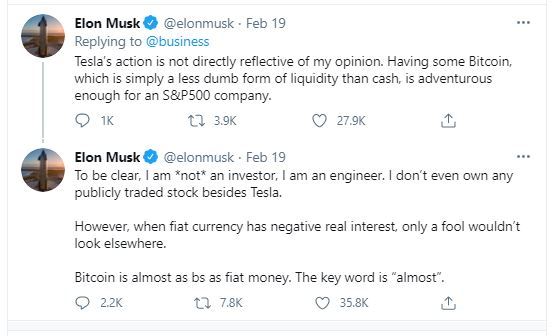

Analysts suggested comments by Mr Musk last week had dented confidence in Bitcoin’s valuation.

He said on Twitter: “Bitcoin is almost as bs as fiat money. The key word is ‘almost’.”

Elon Musk is a big backer of Bitcoin but has cast doubt on its value

Elon Musk is a big backer of Bitcoin but has cast doubt on its value Elon Musk’s tweets have sent the price of Bitcoin tumbling

Elon Musk’s tweets have sent the price of Bitcoin tumbling

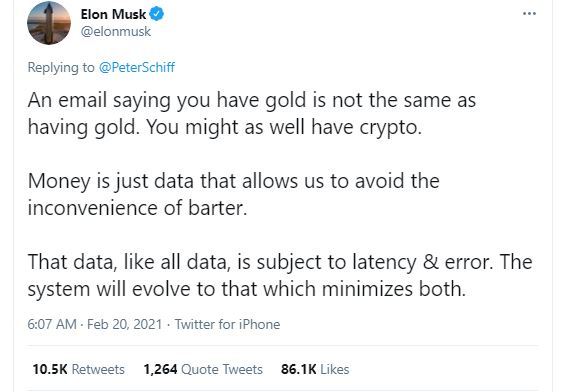

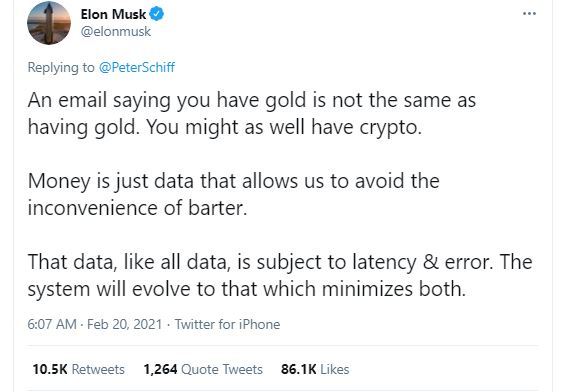

That was followed by another post that said: “Money is just data that allows us to avoid the inconvenience of barter.

“That data, like all data, is subject to latency & error. The system will evolve to that which minimises both.”

City watchdog the Financial Conduct Authority has warned investors should be prepared to lose all their money when investing in cryptocurrencies.

How risky is Ripple’s XRP? The dangers of buying the cryptocurrency explained.

The price of Dogecoin has also surged recently but again, you should be aware of the dangers.