Home Money How to recession proof your finances as UK economy slumps 20%

THE UK has officially entered its “worst ever” recession on record – we look at how to best protect your finances.

It comes as Chancellor Rishi Sunak warned “hard times” are here after the economy suffered its biggest slump on record.

Now could be a good time to check your finances after the UK officially entered into a recession

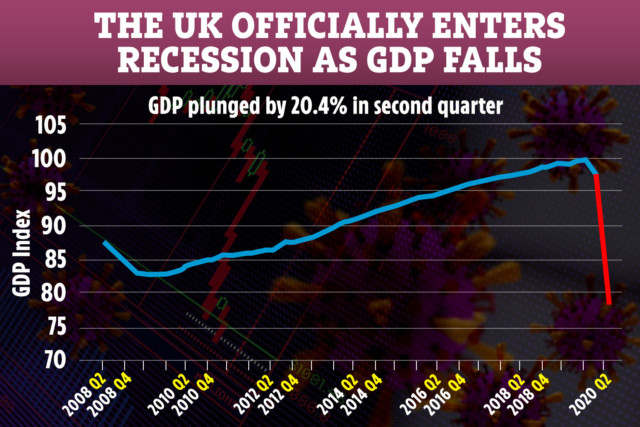

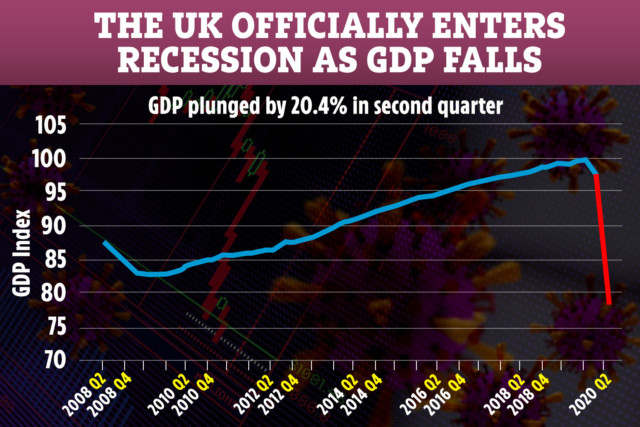

New figures from the Office for National Statistics (ONS) showed gross domestic product (GDP) fell by 20.4 per cent between April to June.

The latest slump means the UK has officially fallen into recession territory for the first time in 11 years, as the impact of the coronavirus crisis on the economy is revealed.

Economists consider two consecutive three-month periods where GDP falls as the technical definition of a recession.

GDP had already fallen by 2.2 per cent between January to March.

UK gross domestic product (GDP) has fallen by 20.4 per cent in the last three months

UK gross domestic product (GDP) has fallen by 20.4 per cent in the last three months

The latest figures come as UK unemployment rose by 730,000 workers since March after another 114,000 Brits lost their jobs last month.

It has been predicted that unemployment could treble to 3million this year.

If you’re worried about your finances, we take a look at the steps you can take to try and keep your cash safe.

Check your finances – can you cut back?

Do a thorough check of your finances so you know exactly where your money is going each month.

Make sure you go through all your bills, as well as any disposable income you have.

Once you’ve got an idea of your spending habits, it’s easier to see where you could make savings.

For example, can you switch energy provider to save money? Or can you make do with a cheaper mobile phone tariff?

Set-up a rainy day fund

Now you’ve got a better idea of your finances, work out how much you can afford to put away each month.

Having a stash of savings gives you a safety net to fall back on if something should happen.

For example, if your car breaks down or you need to replace an essential household white good.

Safety-proof your savings

Make sure your rainy day fund is then protected by the Financial Services Compensation Scheme (FSCS).

This scheme covers cash up to £85,000 per financial institution if the bank goes bust.

Secondly, check you’re getting the best interest rates so you get the most out of your cash.

Use a comparison site, such as Moneyfacts, to check for the best buys.

The top easy-access rate is currently 1.16 per cent – however, you can earn more if you’re able to lock cash away.

For example, the best regular savings rate is 2.75 per cent but you won’t be able to access your money for 12 months.

Banks link savings rates to the Bank of England’s base rate, which means if the base rate drops, savings rates drop too.

Consider fixing your mortgage

If you’re due to remortgage, you may want to consider locking into a cheap fixed deal.

Mortgage rates are also linked to the base rate, and if base rate falls, so do interest rates on mortgages.

Just be aware that if you’ve been furloughed, you’re unlikely to be able to borrow as much from your mortgage lender and you may struggle to remortgage.

You can use a comparison site like MoneySupermarket to compare the best remortgage deals.

Don’t forget your debts

It can be easy to bury your head when it comes to debt, especially if you’re already worried about your money.

But ignoring debts won’t make them go away, so it’s best to tackle any money issues head on.

Make sure you keep track of what you owe, and who to, and always prioritise repaying priority debts.

If you’re really struggling, speak to your lender as soon as possible.

Due to the coronavirus crisis, loan providers, payday lenders and IVA providers have all started offering three month repayment holidays for borrowers.

However, keep in mind that payment holidays are seen as an extreme measure and your debt will still need to be repaid eventually, plus interest.

Always continue paying if you can afford to do so.

There are plenty of organisations where you can seek debt advice for free.

These include:

- National Debtline – 0808 808 4000

- Step Change – 0800 138 1111

- Citizens Advice – 0808 800 9060

Consider consolidating your debts

You could also clear your debt by consolidating it into one loan or card, which would mean you’re effectively borrowing money to pay off what you already owe.

The plus side of this, is you can merge all the money you owe into one monthly repayment with just one lender.

But it’s worth doing your research before committing to a loan, as borrowing more than you can afford to pay back can also lead to a debt cycle that is difficult to get out of.

Explore all your options and ask companies what impact this will have on your credit score, and what happens if you miss a repayment.

Any loan application will appear on your credit record, so be careful not to make multiple applications or you could end up damaging your credit score.

Use a tool such as MoneySavingExpert.com’s eligibility checkers to check which cards and loans you’re likely to be accepted for without it hurting your credit score.

Keep pensions and investments diversified

Now could be a good time to check where your pension or investments are sitting.

If all your savings are in one place, you may want to spread them out so your pots are well diversified.

Being overexposed to one asset class or one particular company could put your savings at risk if something goes wrong.

Credit card and loan payment holidays have been given to 1.7million Brits during the coronavirus crisis.

Meanwhile, furloughed workers are three times more likely to have defaulted on a payment – what help is available?

In January, figures showed there has been a huge jump in Brits taking out payday and short-term loans in the previous 12 months.