MARTIN Lewis has explained why Barclaycard’s minimum repayment hikes could be good and bad news for the millions of Brits having to pay back more each month.

A raft of Barclaycard customers will see their minimum credit card repayments rise from today in a move the bank says will help those in “persistent debt”.

Persistent debt is when you pay more in charges and interest than your actual repayments, making it difficult to pay off what you owe.

Customers with Platinum, Initial, Freedom, Forward, Cashback, Littlewoods, Rewards and Hilton Honors cards will be affected by the changes, but not those with Premier or Woolwich cards.

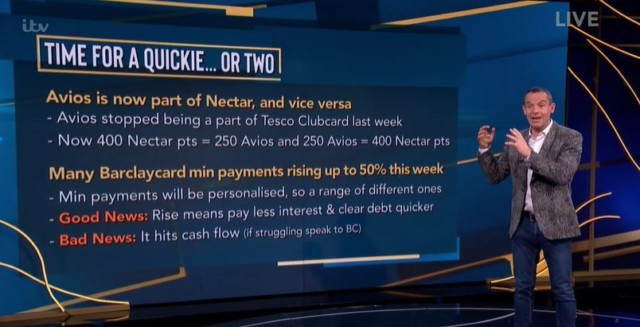

The payments hike could be a good and bad thing for Barclaycard holders, the MoneySavingExpert founder said on his The Martin Lewis Money Show Live on ITV last night.

Although he said minimum payments could rise up to 50 per cent, paying back more each month could be “bad news” because this will hit your cash flow.

If you’re struggling to pay back the money or you can’t afford the payment changes, Martin advised customers to speak to Barclaycard.

“I’m not saying that they will do anything, but they may be able to,” he said.

But paying back more each month could also be “good news”, Martin said.

This is because you will ultimately pay less in interest and clear your debt quicker.

“In general, I would always try and pay more than the minimum payment otherwise you pay a lot in interest,” Martin said.

However, this is unless you’ve got another debt that’s more expensive, in which case Martin advised customers to just pay the minimum repayment on their Barclaycard and pay as much as you can back on your other debt.

The rise in Barclaycard minimum payments comes following tougher regulation introduced in February last year, as lenders have to do more to help those in long-term debt repay it.

As part of the Financial Conduct Authority’s (FCA) shake-up, banks have been encouraging credit card users who only make minimum repayments to increase them over a 36-month period.