MONZO has launched a new bank account with fee-free withdrawals abroad, interest and credit checks.

The new premium account lets you withdraw cash for free when you’re on holiday and regularly shows your credit score in the app – but it will cost you a fiver a month.

You can also earn 1 per cent interest on balances up to £2,000.

Monzo Plus lets account holders take out up to £400 a month from an ATM without being charged when they’re on holiday.

The digital-only bank angered customers when it slapped a £200 a month limit on free holiday cash withdrawals back in 2017. After that, ATM withdrawals are charged at 3 per cent.

But it’s worth noting that if customers go over the limit with the new Monzo Plus card then they’ll also be charged a 3 per cent fee.

This means on £500 worth of withdrawals abroad you’ll be charged £3.

If its this perk that you’re after when opening an new current account, Monzo rival Starling Bank actually offers unlimited free withdrawals when abroad and you don’t have to pay a monthly fee to open an account.

However, the new account comes with a range of extra features that Starling doesn’t have.

Customers who open a Monzo Plus account will also be able to get regular updates on their TransUnion credit score via the app.

Normally, customers have to pay up to £14.99 a month to subscribe to one of the three credit referencing agencies – Experian, Equifax and TransUnion (formerly Call Credit) – to get a detailed credit report.

Although, you can request a basic credit score for free.

It’s not the only bank to offer this feature though – RBS customers have been able to see theirs in the banking app since February and NatWest March.

The new premium account uses open banking so account holders can view up to 13 accounts they hold with other banks, such as HSBC, Barclays, Lloyds and Nationwide.

It’s not new though – HSBC and Barclays has offered this feature for a few years now.

Another perk is that Monzo Plus pays 1 per cent interest on balances of up to £2,000.

We’ve had a look around and found that actually you can get a better deal with the Nationwide FlexDirect account, which pays 2 per cent interest on balances up to £1,500.

Monzo customers can also split their money into separate pots within the app to help them budget, for example one for bills and another for eating out.

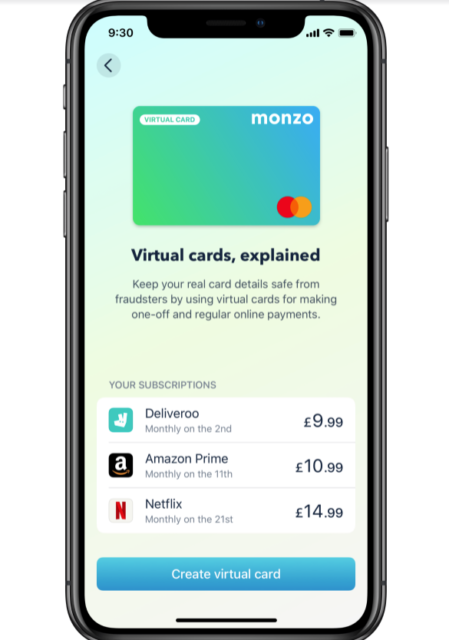

They will then be able to set up up to five “virtual cards”, each with their own details, that you can use to shop online to make sure customers are only spending from what they budgeted.

They’ll also get access to exclusive deals and offers, such as 15 per cent off Patch plant orders over £50 and 25 per cent off FiiT home workout membership.

Monzo has moved away from its iconic coral coloured debit cards for its premium account – instead customers will be issued a holographic blue card.

Mike Hudack from Monzo’s said: “Over and over again we heard that people love Monzo because it gives them more control and visibility over their money.

“So we’ve doubled down on that and created a premium product that we believe makes Monzo even better at managing your money, refocused on benefits that help customers today and in the future.”