WORKERS will get two thirds of their wages covered by the government if their place of work has to close down due to local coronavirus restrictions.

The Chancellor announced the boost to the Job Support Scheme as parts of England and Scotland prepare for tougher lockdown measures.

Parts of the hospitality industry, including cafes, pubs and restaurants, in high risk areas are expected to be temporarily shut down for the second time this year and it could be as soon as Monday.

Rishi Sunak also revealed businesses that are forced to close will be able to claim grants worth up to £3,000 a month from the government.

The payouts will open to places that haven’t yet been able to reopen since March, like nightclubs.

It comes as new data showed the economy grew by 2.1% in August but that the pace of recovery has slowed.

Mr Sunak said: “Throughout the crisis the driving force of our economic policy has not changed.

“I have always said that we will do whatever is necessary to protect jobs and livelihoods as the situation evolves.

“The expansion of the Job Support Scheme will provide a safety net for businesses across the UK who are required to temporarily close their doors, giving them the right support at the right time.”

But Shadow Chancellor Annelise Dodds previously blasted Mr Sunak for waiting until “the last possible minute” to lay out more help.

Here’s everything you need to know about what help has been announced.

Will I get paid if my work has to close due to lockdown?

The latest announcement is an extension to the Job Support Scheme that will be available from November 1.

It has now been expanded to offer extra support for employees working for a business that has been ordered to close under local lockdown restrictions.

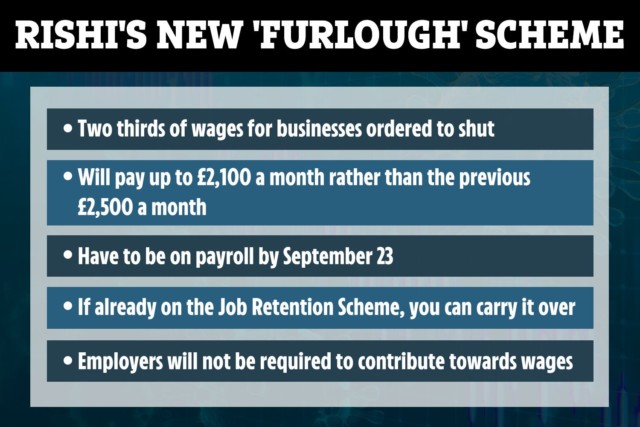

The government will pay two thirds – up to £2,100 a month – of staff wages if their work has been shut down.

Employers will only be required to pay workers’ National Insurance and pension contributions. They can choose to top up wages but they don’t have to.

Mr Sunak said the scheme is “more generous” than the furlough scheme, which currently sees the state cover up to 60% of employees wages, capped at £1,875 a month.

Employers are expected to contribute 20% of furloughed staff salaries, as well as NI and pension contributions.

But the government won’t cover as much of employees wages as it did when the furlough scheme first launched, which was set at 80% up to £2,500 a month.

Restaurants and pubs that have been restricted to just offering takeaways will also be able to take advantage of the help.

Employees can’t work or volunteer for their employers while on the scheme but they can work or volunteer for another business of charity.

Once lockdown restrictions are lifted, workers can then be rolled onto the first part of the Job Support Scheme if employers can’t offer them their full contracted hours due to decreased demand throughout winter.

Workers will also need to have been on the RTI payroll on September 23 to qualify.

An RTI is sent from employers to HMRC, typically on payday.

Members of staff who’d started a new job before the deadline but were yet to receive their first pay cheque are excluded from the scheme.

The same loophole left thousands of “eligible” workers unable to be furloughed.

The scheme will run for six months and be reviewed after three.

How do I claim the new Job Support Scheme help?

Like furlough, employees will be rolled onto the scheme by their employer so you won’t be able to claim it yourself.

It will work in the same way too, with businesses covering the upfront costs and then claiming them back from the government through the Gov.uk portal.

Claims will open from December 2020 and will be paid monthly in arrears.

Employers can only take advantage of the grants while local lockdown restrictions are enforced and employees must be off work for a week before they’re eligible.

The help is available in England, Scotland, Wales and Northern Ireland.

Businesses can claim the help even if they didn’t use the Coronavirus Job Retention Scheme.

What is the Job Support Scheme?

The latest round of financial aid is part of the Job Support Scheme announced last month.

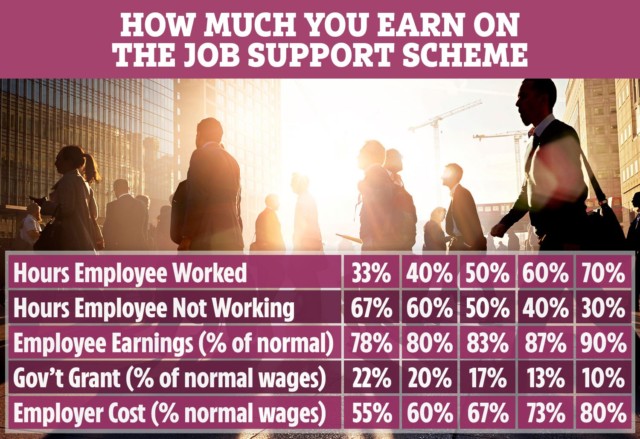

It’s open to employees who are working fewer than normal hours due to decreased demand and will see workers paid two thirds of their salary for the hours they can’t work.

Employers will continue to pay staff for hours that they work – but for the hours they’ve not worked the government and employer will pay one third of their equivalent salary.

In total, someone on the scheme will receive 77% of their total pay, according to The Treasury.

The government’s chunk of the support will be capped at £697.92 per month.

To be eligible, employees must be working at least a third of their contracted hours.

Employees are allowed to work more than a third of their contracted hours and still be eligible for the scheme, but the amount the government will pay is reduced.

For example, an employee working half of their normal hours will receive 83% of their total pay packet.

The government will cover 17% of their normal wages, while the employer will pick up 67%.

Anyone who is in employment as of September 23 can be put on the scheme – and it’s open to all small and medium-sized businesses who didn’t apply to furlough before.