STRUGGLING borrowers have been warned to steer clear of illegal loan sharks offering “quick cash fixes” that are likely to make their problems worse.

Many people across the UK have suffered income shocks due to the financial impact of the coronavirus crisis, having been furloughed, seen their pay cut or lost their job.

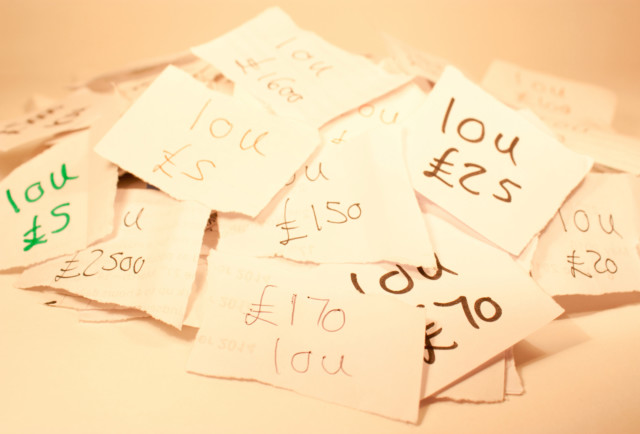

Struggling borrowers have been warned against using loan sharks

But the Local Government Association (LGA) says it is concerned people may wait until they are in severe financial difficulties and debt before they seek help, or could turn to loan sharks instead.

It warns that money lenders operating outside the law may charge sky-high interest rates, rely on extortion, rarely issue paperwork and are likely to plunge people into deeper debt for longer.

In the most extreme cases, loan sharks have been prosecuted for blackmail, violence and kidnap offences, according to the LGA.

Simon Blackburn, chairman of the LGA’s safer and stronger communities board, said: “These illegal loans typically come with astronomical interest rates, soon spiral into uncontrollable debt that can never be repaid, and are typically enforced through intimidation and violence.

“There are much better, safer and cheaper ways people can manage their money.”

For those who are struggling, we outline some of the alternatives you could consider.

If you already have debts – ask your lender for help

Many firms are offering payment freezes during the coronavirus crisis to help those with sudden holes in their budgets because of coronavirus.

Of course you still need to make these repayments eventually, and it can mean higher costs in future due to interest racking up, but if you need to ease the pressure on your finances right now it could be a good place to start.

Mortgage providers, for example, are offering up to six-month repayment holidays, while car finance and payday loan providers are offering up to three-month repayment freezes.

Banks have also been encouraged to give up to £500 interest-free overdrafts to existing borrowers and to ensure customers aren’t stung by hefty overdraft interest rates.

IVA firms, meanwhile, are also offering three month payment holidays or a 25 per cent cut in repayments due to coronavirus.

And some lenders may go above and by waiving charges and interest on debts too.

Just bear in mind that while taking out any of this coronavirus help won’t impact your credit score, it may harm your ability to take out credit in future because lenders take into account other factors besides your score.

Look at alternatives to high cost credit loans

Firstly, use online calculators, such as these ones from charity Turn2Us, to make sure you’re not missing out on any benefits or grants.

If there’s nothing free you’re entitled to, the next step is to look for the cheapest source of credit.

The LGA says anyone experiencing money problems can contact their local council to find out what help is available.

It says low cost loans may be available from local Community Development Financial Institutions, as well as from credit unions.

Contact your local council and find your nearest credit union to check what products are on offer.

If your credit score is good enough, also consider a 0 per cent credit card which you can use for purchases or to transfer more expensive debts onto.

Just make sure you make the minimum repayments each month and ensure you can clear the debt before the 0 per cent ends and you begin to be charged interest.

MoneySavingExpert’s eligibility calculator will let you know what deals you will likely qualify for.

Get free debt advice

Mostly importantly, don’t bury your head in the sand. There are free organisations you can turn to, such as:

- National Debtline – 0808 808 4000

- Step Change – 0800 138 1111

- Citizens Advice – 0808 800 9060

If you’re seriously struggling with multiple debts they may suggest a debt management plan, an IVA, a debt relief order, or bankruptcy. But don’t commit to any of these without independent advice beforehand.

See our 11 steps for getting out of debt, including the best balance transfer 0 per cent credit cards, for more help.

Did you miss our previous article…

https://www.hellofaread.com/money/let-your-senses-travel-with-mrs-crunchs-exotic-and-tasty-recipes/