THE value of Dogecoin has dropped from earlier record highs.

But what is the cryptocurrency and why is it dropping? We explain what you need to know.

Follow our cyptocurrency live blog for the very latest news on Bitcoin, Dogecoin and market surges…

But first, a word of warning: buying cryptocurrencies as well as stocks and shares is a risky business.

Investing is not a guaranteed way to make money, so make sure you know the risks and can afford to lose the money.

Cryptocurrencies are also highly volatile, so your cash can go down as well as up in the blink of an eye.

What is Dogecoin?

Dogecoin is a cryptocurrency which was launched in 2013.

Originally invented as a joke by software engineers Jackson Palmer and Billy Markus, the Dogecoin has the image of a Shuba Inu dog as its logo.

It has been marketed as the “fun” version of bitcoin.

Two weeks after its launch, the value of it jumped 300% after China banned banks from investing in cryptocurrencies, according to Investopedia.

Dogecoin then skyrocketed alongside other cryptos during the bubble that peaked in 2017, and it fell with the rest of them over 2018.

At its height, Dogecoin was trading for $0.018 per coin, according to crypto data firm CoinMarketCap.

Why is the value of it going down?

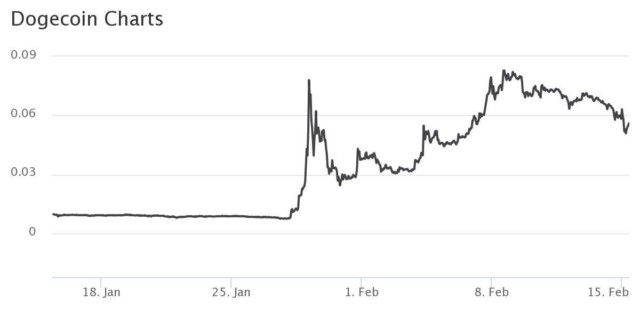

At its height on February 7, Dogecoin was trading for $0.085 6.1p) per coin, according to crypto data firm CoinMarketCap.

It has dropped as much as 20% since then and is currently trading at $0.056 (4p) at the time of writing on Monday morning (February 15).

Dogecoin soared to record highs after entrepreneur and Tesla chief executive Elon Musk tweeted about the cryptocurrency.

Other famous people including Snoop Dogg and investor Mark Cuban; have also tweeted their support of Dogecoin.

It first saw a surge on January 29, jumping by a staggering 972% from $0.007 (less than 1p) the day before.

That was off the back of a bunch of Reddit threads calling for it to hit a value of $1 per coin.

The target was an attempt to mirror the recent share surge in heavily shorted companies like GameStop.

Shares in GameStop soared by a staggering 700% earlier in January.

Shares rocketed after an army of amateur traders targeted the games retailer, causing professional hedge funds who’d shorted it to lose billions.

But for the amateur traders, the surge saw them make some serious cash.

In simple terms, “short selling” is when professional investors borrow shares of stock to sell, and then buy them back at a lower price.