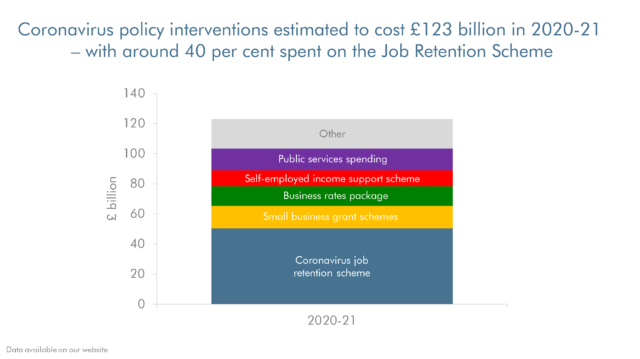

BRITAIN will have to borrow £123billion this year alone to pay for the coronavirus crisis, independent analysts have said.

The Office for Budget Responsibility reckons that the country will have to fork out £56 billion just for the Government’s furlough scheme.

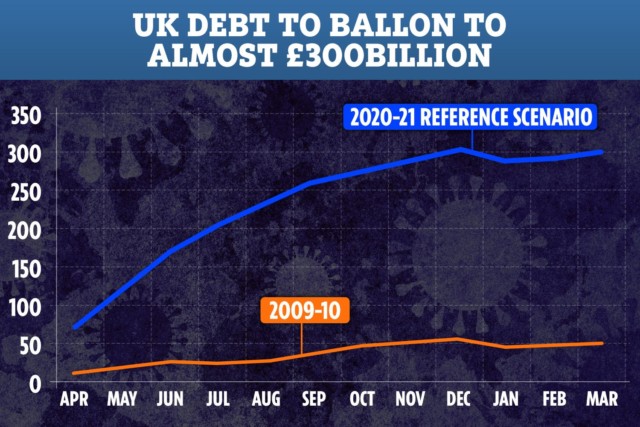

The OBR’s updated figures estimate public debt will balloon to £298 billion by the end of 2021.

More than 7.5 million people have been put on the coronavirus job retention scheme which pays 80 per cent of Brits’ wages out of the public purse up to £2,500 a month.

The scheme is running at around £14 billion a month according to the OBR.

The estimates are made on the basis employers will start paying their workers’ wages again by August.

But Chancellor Rishi Sunak extended the scheme to run until October earlier this week.

The OBR cautioned: “There is insufficient detail for us to reliably estimate the cost of the post-July period at this stage, though the Chancellor has said he expects the Treasury to continue paying ‘the lion’s share’.”

Speaking in the House of Commons earlier this week MR Sunak said: “Until the end of July there will be no changes (to the furlough scheme) whatsoever.

“Then from August to October, the scheme will continue for all sectors and regions of the UK but with greater flexibility to support the transition back to work.

“As we reopen the economy we need to support people back to work.

“Between August and October, the scheme will continue but with greater flexibility to support people back to work.

“We will share the cost of paying people’s salaries.”

Figures revealed last month more than half of working age Brits are receiving Government support after coronavirus forced the nation into shutdown.

Income support for the self-employed, which gives similar support as the furlough scheme, is expected to cost £9billion.

Borrowing for local authorities will also rise to £10.9 billion on the OBR’s estimates, as cash-strapped councils face looking at making cuts to social care and bin collection to fill black holes in their budgets.

Debt will hit 110 per cent of GDP in September.

The bleak economic outlook from the OBR stokes fears the UK could be plunged into the worst recession in 300 years.

The bleak economic outlook from the OBR stokes fears the UK could be plunged into the worst recession in 300 years.

Last week, the Bank of England warned coronavirus could see the economy plunge 14% this year in the worst annual fall since records began more than 300 years ago.

Bank of England Governor Andrew Bailey said economic activity in the UK has “dropped sharply”.

They warned 1.5 million Brits could be left without a job.

The OBR said if the lockdown last three months, following by a partial easing of measures for another three months, GDP could jump 25 per cent in the third quarter of 2020 and another 20 per cent in the final three months of the year.

Senior Tories have vowed not to bring back austerity to fix the gaping hole in the nation’s purse.

Transport Secretary Grant Shapps said yesterday Britain would not be plunged back into a “world of austerity” once the crisis is over.

Boris Johnson said last month he had “never liked” the word austerity.