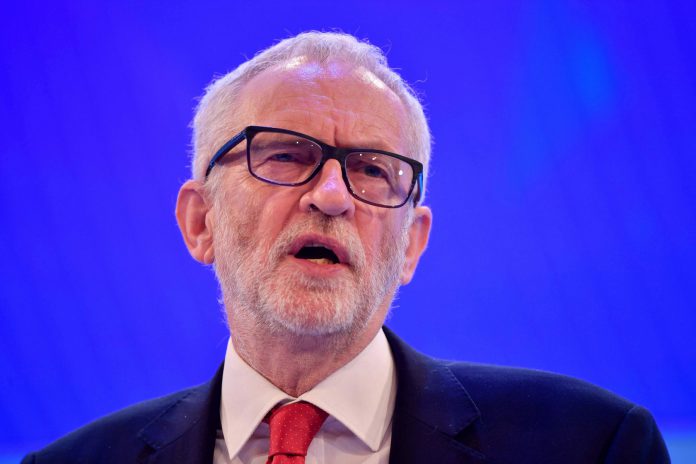

JEREMY Corbyns radical plans to increase taxes for the wealthy could cost the economy 1billion.

Labour proposals would hit the pockets of 1.6million Brits while the actual revenue it would raise is “highly uncertain”, experts claim.

COST OF CORBYN

John McDonnell will increase the contributions of people earning more than 80k a year from April 2020, according to analysis by the Institute for Fiscal Studies (IFS)

The IFS suggests this is in line with Labour’s commitment for just the top 5 per cent of earners to be asked to pay more.

However, the economists also said it would affect “ever more people over time”, with approximately 1.9 million people having incomes exceeding 80,000 in 2023/24.

The IFS also said a “reasonable” estimate for the revenue raised by the plan is around 3 billion a year.

Mr McDonnell wants to rewrite the rules of our economy and has previously said Labour’s policies would result in the top 5 per cent of earners being asked to “pay a little bit more”.

‘HIGHLY UNCERTAIN’

Attacking Britains wealthy has been a consistent theme in Labours election campaign with the Shadow Chancellor telling voters no one deserves to be a billionaire.

Despite business chiefs warning the partys hard-left approach could see major firms fleeing from Britain.

Labour is set to confirm its manifesto tomorrow with a change to income tax set to be announced.

The threshold for the 45p additional rate lowered to 80,000 – from 150,000 – and a new 50p rate on earnings above 125,000 introduced.

The additional rate was 50p for earnings above 150,000 from April 2010 until it was lowered to 45p in March 2012.

The IFS briefing note states: “The tax revenue that Labour’s proposals would raise is highly uncertain, and depends on the extent to which people reduce their taxable incomes in response to the rise in income tax.

“If no-one changed their behaviour, the tax rises would raise around 10 billion per year on average between 2020/21 and 2023/24.

“Given existing evidence on how the affected group responds, a reasonable central estimate for the revenue raised is around 3 billion per year, but it is also plausible that it could raise 6 billion or that it could reduce revenue by 1 billion.

“All else equal, people would respond less to the tax rise if avoidance opportunities were fewer, so introducing other measures as well might affect the amount it would raise.”

Conservative Treasury minister Simon Clarke claimed Labour is planning a “reckless spending spree that everyone will end up paying for”.