RISHI Sunak has turned from “Santa to Scrooge” and is expected to clobber Brits with another tax bombshell, top economists have warned today.

The Institute for Fiscal Studies poured cold water on the Chancellor’s plans, warning they cannot be delivered without considerable “pain”.

Read our Budget 2021 live blog for the latest news & updates

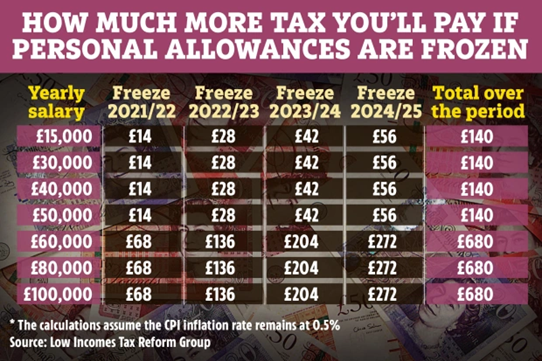

A staggering 1 million people will be dragged into paying the higher rate of income tax by 2025 thanks to the Chancellor’s plans, they warned – taking the total to 5 million.

But policy wonks at the Institute for Fiscal Studies warned the Chancellor will have to launch a fresh tax raid on families to plug the holes in the budget.

He has massively underestimated the amount of cash needed to fund public services after Covid, they warned.

While he risks harming jobs and growth by whacking up Corporation Tax to 25 per cent in the years ahead.

Richard Hughes, from the Office for Budget Responsibility, warned the hike will probably “have consequences for investment”.

Paul Johnson, from the IFS, warned that further tax rises are likely to lie ahead and said it was a “tale of two budgets” as the Chancellor extended several support packages including furlough for months to come.

He said the tax burden is set to rocket to levels not seen since the 1960s, and warned gloomily: “It is possible we’ll see even bigger ones over the next few years”.

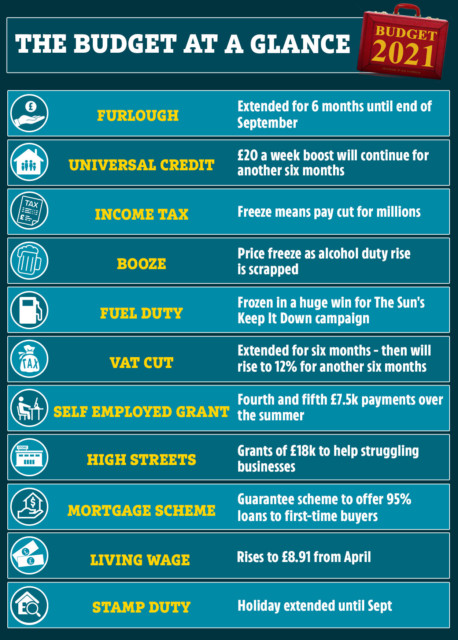

The Chancellor also announced in the Budget yesterday:

- Corporation tax will rise to 25% in April 2023, from 19% in a sting for businesses

- The pension lifetime allowance will be frozen at £1,073,100 until April 2026, instead of rising in line with inflation as planned

- Inheritance tax and capital gains tax will be frozen until April 2026

- Fuel duty will be frozen in a huge win for HOAR’s Keep It Down campaign

- The VAT cut will be extended for another six months – and then it will go up to 12% for another six months after that

Mr Sunak plans to slash a whopping £14bilion from government spending in the next five years.

The axe could fall hard on social care and policing as other departments, like the NHS and aid, have seen their budgets protected.

Mr Johnson said: “Take account of the cuts to planned spending announced in the Autumn and Santa Sunak, purveyor of billions today looks more like Scrooge Sunak cutting spending and raising taxes to the tune of nearly £50 billion relative to his pre-pandemic plans of March 2020.”

If spending plans and tax hikes go as planned, the Government will be able to balance the books by 2025, according to the IFS.

“The sad truth is that that would be a balance built on the highest sustained tax burden in UK history and yet further cuts in unprotected public service spending,” Mr Johnson added.

The Resolution Foundation warned that “austerity” will continue for many government departments.

But Treasury sources insisted the plan is a “growth Budget” which will protect jobs and the economy.

The IFS said the income tax moves mean one in six adults will be paying the higher rate of income tax by the end of the forecast period.

Earlier today Mr Sunak defended his income tax plans as the most progressive and fair way forward.

The Tories have repeatedly raised the income tax brackets over the past decade, bringing millions of lower paid people out of paying tax at all.

For basic rate taxpayers the threshold will be held at £12,570 and £50,270 for higher rate tax payers.

Experts have predicted that lower paid Brits could lose £576 over 5 years – if they don’t get a pay rise, and without including National Insurance.

Mr Sunak told Sky News this morning: “Freezing personal tax thresholds is a progressive way to raise money. I think crucially what people need to understand is that no one’s take-home pay that they have today is affected or lowered by this policy.

“What it does do is remove the incremental benefit that they might have experienced in future as inflation fed through to their wages.

“Also crucially, those on higher incomes are affected more by this policy – it is a very progressive policy and that is something that has been noted by independent think tanks that are respected, like the Institute for Fiscal Studies and others who have made the point that the richest 20 per cent of households, for example, will end up contributing I think 15 times more than those on the lowest incomes.

“That is why this is a fair way to help solve the problems that we need to.”