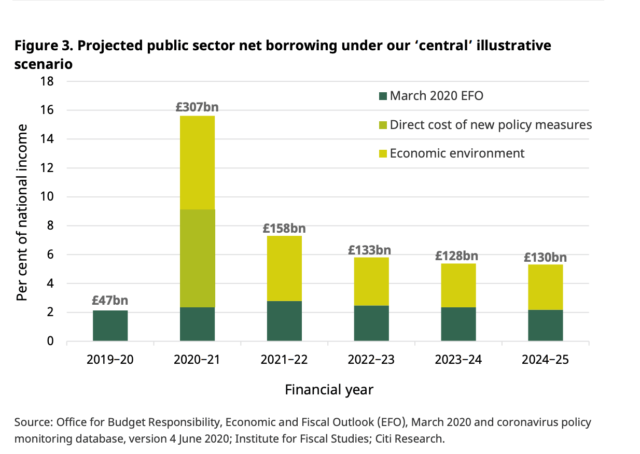

BRITS are facing tax hikes to plug a £130 billion black hole in the nation’s purse from the coronavirus crisis, experts have warned.

The economic shutdown because of the pandemic slashed nearly two decades of growth in the UK and borrowing levels will hit levels not seen since World War 2, the Institute of Fiscal Studies has warned.

Chancellor Rishi Sunak will need to come up with £30 billion to £40 billion worth of tax hikes or spending cuts just to stabilise debt levels at 100 per cent of GDP after borrowing more than £300billion to bail out the Britain, the report warned.

The PM has previously said he is “not a fan” of massive spending cuts, and will push ahead with the manifesto of “levelling up Britain” with extra money plunged into national projects such as infrastructure.

Britain’s economic has suffered a huge hit from lockdown and lasting damage could leave borrowing at 5 per cent of national income – or £130 billion by 2024-25.

The IFS has projected that the deficit for next year could rise to 20 per cent of national income – only 5 per cent less than borrowing levels during World War Two.

IFS economist Isabel Stockton warned: “A mix of some tax rises alongside an acceptance that higher debt will need to be managed for decades to come.”

She said the state of public finances “will depend greatly on the strength of the subsequent recovery.”

The report by IFS and Citi also warned the weakening of the UK economy could cause unemployment to increase and household purse strings to tighten.

If the UK boosted spending on welfare, health and social care – a key promise of Boris Johnson’s election pledges – there would need to be even bigger tax increases to pay for it, the IFS said.

UK economist at Citi and co-author of the report, Ben Nabarro said: “Shut-downs resulting from COVID-19 have slashed nearly two decades of growth from the UK economy in just two months.

“As the economy reopens, growth will inevitably rebound.

“However, a full recovery in output is unlikely to be quick and simple. In the aftermath of COVID-19 and Brexit, the structure of the UK economy is likely to change materially.

“This implies persistent unemployment, weaker household sentiment and a slower recovery.

“It also makes it more likely the crisis results in significant permanent losses in UK output.”

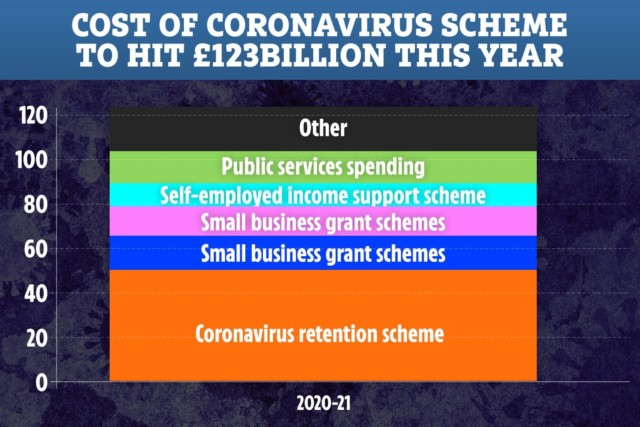

Government borrowing could still be as high as £158 billion next year, after recording spending on schemes such as the furlough scheme – which has been estimated to cost around £14billion a month.

Official figures are expected to confirm on Friday that public borrowing eased slightly to £47bn in May, down from the record £61bn for April.

According to the IFS, even in their “more optimistic scenario”, borrowing in 2024-25 would be about £40billion more – or two thirds higher – than was forecast in Rishi Sunak’s March 2020 Budget.