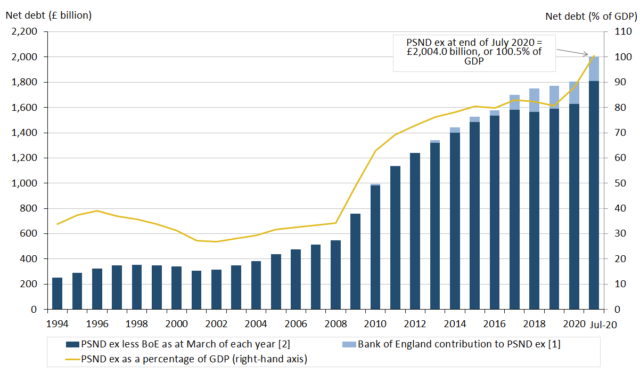

BRITAIN’s borrowing has skyrocketed to over £2 trillion for the first time in HISTORY.

Fresh figures from the Office of National Statistics show UK public debt stands at £2,004 billion – or 100.5 per cent of the nation’s GDP.

The massive leap in debt is £227.6 billion more than this time last year.

Most of the extra debt was taken on to afford the financial aid dished out by the Treasury to people and businesses across the UK to stymie a rush of job losses during the coronavirus pandemic.

The ratio of debt-to-GDP – at 100.5 per cent – is the highest it has been since March 1961.

Chancellor Rishi Sunak spent record sums of money guaranteeing people’s wages through the furlough scheme, which the ONS said was costing £7.1 billion in July.

Total expenditure in July hit £81.1 billion – an increase of 22.9 per cent from the same time last year.

The public sector had to borrow £26.7 billion in July – a month where borrowing is traditionally low because tax revenue would normally hit Treasury’s coffers.

The ONS said it was the “fourth highest borrowing in any month on record” since figures started being collected in 1993.

Borrowing throughout the peak of lockdown – from April to July – stood at around £150.5 billion – 128.4 billion higher than last year.

Of spending during April to July a whopping £45.2 billion was accounted for by the Government’s furlough schemes – including propping up the self-employed.

The Government’s furlough scheme is being slowly wound down, and will end entirely in October.

From September, the Government will pay 70 per cent of an employees wage – instead of 80 per cent paid through the pandemic – and employers will have to top up 10 per cent.

The Government’s contribution will fall again in October to 60 per cent, before the scheme comes to an end.

As part of the plan to help boost consumer spending, Mr Sunak slashed VAT to 5 per cent – which will mean there is less money coming into the Treasury.

Did you miss our previous article…

https://www.hellofaread.com/politics/islands-like-canaries-ibiza-mallorca-could-be-added-to-safe-travel-lists-as-gov-explores-regional-quarantines/